In the U.S., cannabis prohibition is fading fast. If you’re thinking about making money from this market, you can get access by investing in cannabis with ETFs.

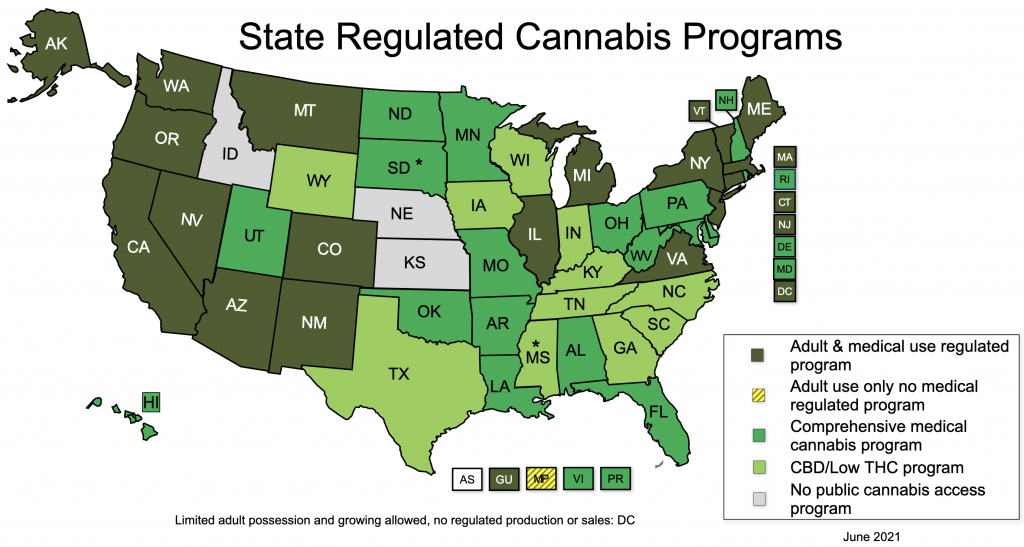

First, let’s talk briefly about the current market. The past few years have been a whirlwind of activity for cannabis legislation. State by state, medical and recreational laws are changing. There are now 36 states which regulate medical cannabis use, and 18 which allow recreational use. And even more states allow CBD. Here’s a great map from NCSL with the state-by-state details:

So as we can see, the environment in the U.S. is evolving. In time, it’s possible that the cannabis market will become well-established nationwide just like alcohol, tobacco or other common industries.

When investing, you can try to find a few individual companies that will end up being long-term winners, but the chances of picking the right ones are slim. I like using ETFs because they are an easy way to get exposure to a diversified basket of different stocks. Investing with an ETF can give you broad exposure to any sector you’re interested in, and eliminate the need for picking a single winning stock.

If you’re interested in this growing (and now legal) market, here are 7 ETFs to consider:

🌱 MSOS – AdvisorShares Pure US Cannabis ETF

🌱 YOLO – AdvisorShares Pure Cannabis ETF

🌱 POTX – Global X Cannabis ETF

🌱 THCX – The Cannabis ETF

🌱 TOKE – Cambria Cannabis ETF

🌱 CNBS – Amplify Seymour Cannabis ETF

🌱 MJ – ETFMG Alternative Harvest ETF

Picking the right ETF for your portfolio depends on a few important factors. I’ll cover the top funds for each category below.

It’s important for me to first mention that I don’t recommend this for everyone; for most people, picking a broad market ETF (like SPY or VOO) is the best way to go. However, if you understand the risks and want to allocate some of your investments to the cannabis sector, read on.

AUM (Assets Under Management)

In total, these 7 ETFs have about $3 billion in assets under management. This is quite low in the world of investing, where popular sector ETFs like XLE (energy) or XLF (financials) can boast AUM of $23B or $42B, respectively. Of course, the cannabis sector is still relatively young, so it might not be fair to compare these funds to those which are significantly older and more established.

Almost half of that total $3 billion comes from just one fund, MJ. It’s the oldest ETF of the group by far, which has given it a big head start attracting people who are interested in investing in cannabis with ETFs.

On the other end of the spectrum, some of these ETFs are incredibly small. TOKE can claim only about $33 million under management, which is puny. THCX, CNBS and POTX are also on the small side, each in the mid-$100 millions.

Number of Holdings

If you’re looking for maximum diversity, THCX comes in first, with 32 different holdings. MSOS is dead last, with just 11. Among the entire group, the average number of holdings is 26.

Most of these funds hold similar companies, like Tilray, Inc. and Canopy Growth Corporation. Why? Well, there aren’t that many public cannabis companies to choose from yet, so the same big ones are represented in most of these funds

Geographic Diversity

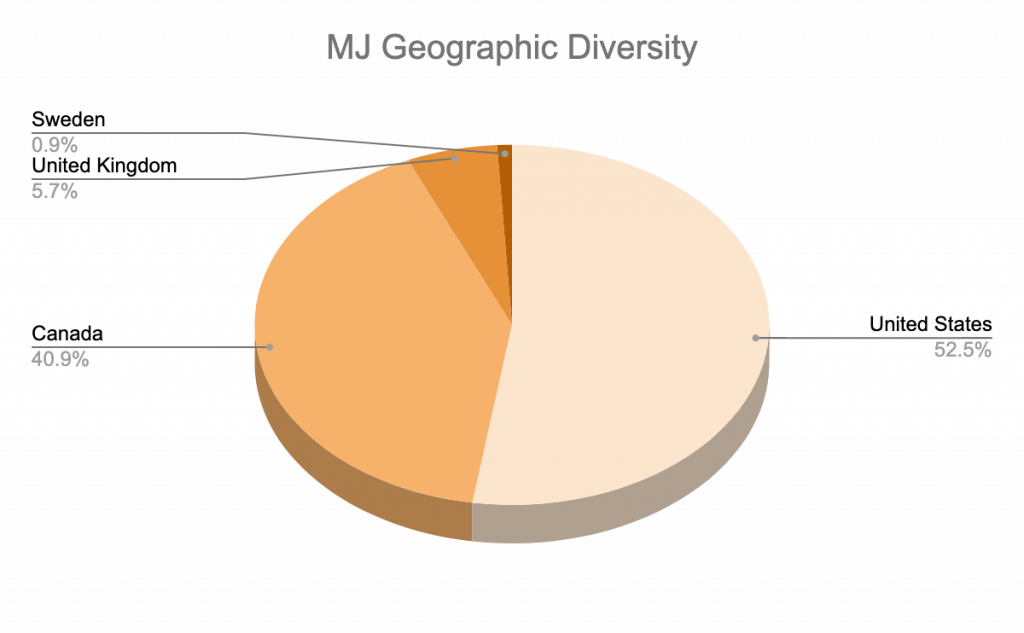

All of the ETFs in this group focus most of their attention on the U.S. and Canadian markets; companies from these two countries can be found in every fund. However, a few offer exposure to other countries like Israel, the U.K., Australia and Sweden.

MJ is the most geographically-diverse fund, covering 4 countries: the U.S., Canada, the U.K. and Sweden.

It’s interesting to note that no single fund offers exposure to all 6 of these countries. If you want maximum geographic exposure, you’ll need to go with a mix of at least 3 different funds. For example, MJ will give you access to the U.S., Canada, the U.K. and Sweden. Holding YOLO will add Israel to the mix, and POTX will add Australia.

Even with a portfolio of different ETFs, holdings are still extremely concentrated in the U.S. and Canada. Consider that Israel makes up just 0.35% of YOLO, and Australia just 2.62% of POTX. Fund holdings of U.K. and Swedish companies are similarly small.

Expense Ratios

When picking an investment for the long term, expense ratios are always important. I generally want to pick something with the lowest ratio possible. If you want to know why, do some math on your expected returns both with and without fees. Even something as low as 1%, which might not seem extreme, can have a massive impact on your returns over time.

Among this group of ETFs, most expense ratios are basically the same at 0.74% or 0.75%. TOKE is the cheapest at 0.42%.

| ETF | Expense Ratio |

| TOKE | 0.42% |

| POTX | 0.51% |

| MSOS | 0.74% |

| THCX | 0.75% |

| YOLO | 0.75% |

| MJ | 0.75% |

| CNBS | 0.75% |

If you compare this list to a broader ETF like VOO, at 0.03%, you’ll see that even the cheapest among them is wildly more expensive. If you want a concentrated focus on this sector, you’re going to pay for it.

So there you have it: all you need to get started. What do you think? Is this a good sector to invest in?

If you’re interested in reading further, check out a couple of articles:

1 comment