How will the stock market react to the Omicron variant?

We’re all hearing about the latest Covid variant, Omicron, in the news. Are you letting that affect your long-term investment plan?

Maybe taking a look at how the market performed last year, when Covid first became a concern, can help put things into perspective.

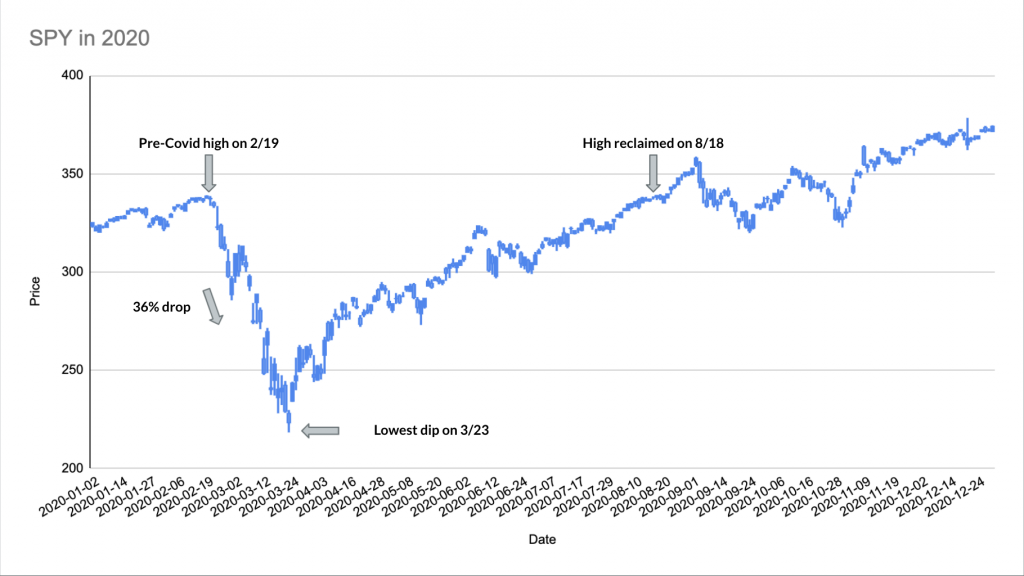

For this chart, I’ve chosen SPY, which is a popular S&P 500 ETF. This tracks the 500 companies in the S&P 500 index.

As we can see here, when the market crashed in February of 2020, it fell about 36% over the course of a month. Then it began a steady recovery, finally reclaiming its previous high in August.

In all, this lasted about 6 months.

6 months without your investments being at the highest they’ve ever been.

Are you prepared for that?

With a long-term focus, any 6 month period soon fades away into nothing but a memory. Staying invested throughout 2020 brought major gains for investors. SPY is now up about 26% on the year, and only 3% from its all-time high.

Keep in mind that this chart likely shows a worst-case stock market scenario for a new Covid variant. In early 2020, we had almost no idea what to expect with Covid, but we’ve learned a lot since then and are better equipped to handle new variants as they arise.

The market basically shrugged off news of the Delta variant earlier this year, with barely a blip in most indexes. My guess is the reaction to Omicron will be similar. But, I can’t predict the future; and neither can anyone else.

Unless one of us finds a crystal ball, we’ll have to just wait and see how the stock market reacts to the Omicron variant.

If the thought of holding through a downturn like this makes you woozy, check out some of the books I recommend on investing psychology.